Good Ideas For Picking RSI Divergence Trading

Wiki Article

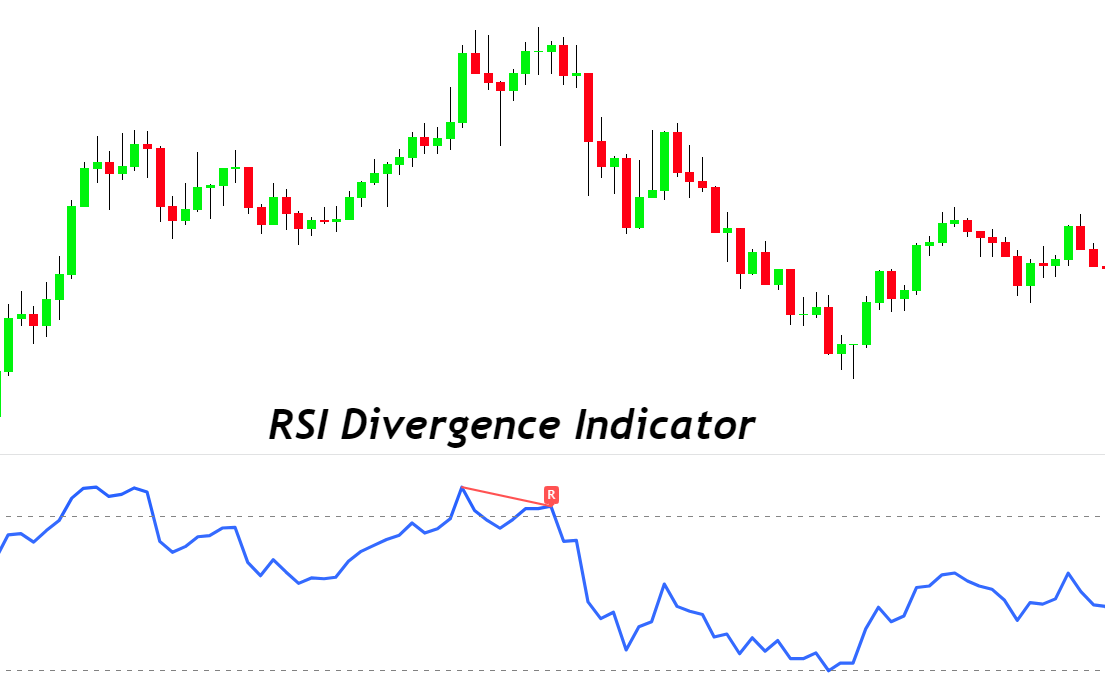

Let's begin with the most obvious question and find out what RSI Divergence is and what trading clues we can get from it.|Okay, let's start with the most obvious question. Let's look into the meaning behind what RSI Divergence means and what trading signals it could give.|Let's start with the most obvious question. We will explore the meaning of RSI Divergence actually is and what trading insights we can get from it.|Okay, let's begin by asking the obvious question. Let's look at the meaning behind RSI Divergence really is and what trading signals we can learn from it.|Let's begin with the most obvious question. Now, let's examine the what RSI Divergence looks like and what trading clues can be drawn from it.} Divergence happens when the price action isn't in line with the RSI indicator. In the case of a Downtrend market the price action will create lower lows while the RSI indicators will make higher lows. Also, divergence could occur when the indicator doesn't match the price movement. If this occurs, you should pay attention. The chart shows that both the bullish RSI diversgence as well as bearish RSI diversion are clearly visible. Actually the price action was reversing after receiving the two RSI Divergence signals. Let's look at one final issue before moving on to the thrilling topic. Have a look at the top rated position sizing calculator for website examples including RSI divergence, bot for crypto trading, best forex trading platform, automated trading platform, divergence trading, bot for crypto trading, crypto trading bot, position sizing calculator, best crypto trading platform, cryptocurrency trading and more.

What Is The Best Way To Analyze Rsi Divergence

We are using RSI to determine trend reversals. Therefore, it is vital to determine the most appropriate one.

How To Recognize Rsi Divergence In Forex Trading

Both Price Action indicator and RSI indicator reached higher levels during the uptrend's beginning. This is usually a sign that the trend is strong. But at the conclusion of the trend, Price makes higher highs, but the RSI indicator made lower highs that indicate that there is something worth watching in this chart. Here we should be paying attention to markets, as both the indicator's actions and price are outof the sync. This means there is an RSI divigilance. In this case it is the RSI Divergence suggests a bearish tendency rotation. Check out the graph to observe what happened immediately following the RSI Divergence. It is evident that the RSI Divergence is extremely specific in identifying trends that reverse. The question is: How do you actually spot a trend reversal? Let's talk about four trade entry strategies that provide higher probability of entry when used in conjunction with RSI divergence. View the recommended backtesting tool for blog recommendations including automated trading, cryptocurrency trading bot, online trading platform, cryptocurrency trading, crypto trading, divergence trading, forex backtesting software, automated trading, backtester, automated crypto trading and more.

Tip #1 – Combining RSI Divergence & the Triangle Pattern

Triangle chart pattern comes with two variations, One is ascending triangle pattern that used as a reversal pattern in a downtrend. Another variation is the descending circle pattern, which acts as a reverse pattern in an upward trend market. Below is the downward triangle pattern. Similar to the previous example, the market was still in an uptrend but eventually the price began to decrease. RSI can also be a signal of divergence. These clues indicate the negatives of this trend. Now we see that the speed of the ongoing uptrend has decreased and the price was capped in a descending triangular pattern. This even confirms the reversal. It's now time for the short trade. Like the previous trade we employed the same breakout techniques for this trade. Let's now look at the third trade entry strategy. This time, we will combine trend structure with RSI diversgence. Let's look at how we can trade RSI diversion when the structure of the trend is changing. Check out the recommended rsi divergence cheat sheet for website examples including trading platform cryptocurrency, trading platform, forex backtest software, automated trading software, trading with divergence, automated trading, divergence trading forex, crypto trading bot, crypto backtesting, backtesting and more.

Tip #2 – Combining RSI divergence with Head and Shoulders Pattern

RSI Divergence is a way to help forex traders spot market Reversals. Combining RSI diversence along with other indicators of reversal like the Head and Shoulders patterns could increase our chances of winning. That's fantastic! Let's see how we can plan our trades using RSI divergence, as well as the pattern of the Head and Shoulders. Related - How to Trade Head and Shoulders Patterns in Forex - A Reversal Trading strategy. An enviable market conditions are required before you can trade. Trending markets are preferred as we are trying to identify a trend reversal. The chart is below. See the top rated automated trading for blog tips including forex backtesting software, best trading platform, backtesting platform, backtester, crypto backtesting, backtester, crypto trading backtesting, stop loss, backtesting strategies, crypto trading backtesting and more.

Tip #3 – Combining RSI divergence with the trend structure

Trend is our best friend. We must trade in the direction of trend for as long as the market continues to trend. This is how professionals teach us. But, the trend is not going to last for ever. At some point, it will reverse. Let's take a look at the structure of trends and RSI divergence to see how we can spot reversals early. We know that the trend is making higher highs, while the downtrend is making lower lows. Look at that chart. It shows an upward trend, with a lower series of lows and higher highs. Let's take a look (Red Line) at the RSI divergence. The RSI makes higher lows, whereas price action makes these. What does this mean? Despite the fact that market created lows, the RSI does exactly the opposite. This means that a downtrend is ongoing and has lost its momentum. It is time to get ready for a reversal. Check out the top rated trading with divergence for website tips including automated forex trading, forex trading, automated trading, crypto trading, crypto trading backtesting, automated forex trading, trading divergences, automated trading bot, trading platform, crypto trading backtesting and more.

Tip #4 – Combining Rsi Divergence With The Double Top And Double Bottom

Double top, also referred to as double bottom, is a reverse-looking pattern that occurs after an extended movement or following an upward trend. Double tops are formed when the price is at an unbreakable threshold. Once that level is reached it will then retrace little before returning to its original level. DOUBLE TOPs happen in the event that the price bounces off this level. Check out this double top. The double top you see above shows two tops which resulted from a powerful move. You can see that the second top was not able to surpass the first. This could be a sign of an inverse. It's telling investors that they have a hard time going higher. The double bottom also uses the same principles but is performed in an opposite direction. We employ the breakout trade entry technique. This means that we will sell the trade when the trigger line has crossed below the price. We took our profit after the price had fallen to below the trigger line. QUICK PROFIT. Double bottom also requires the same techniques for trading. Take a look at this chart to learn the best way you can trade RSI divergence and double bottom.

Be aware that this isn't the perfect all trading strategy. There isn't any one trading strategy that is ideal. Every strategy for trading has losses. Profits are consistent from this trading strategy BUT we're using a tight risk management and a technique to reduce our losses rapidly. That will reduce our drawdown, which could allow for huge upside potential.