Best Ideas On Choosing Forex Trading Websites

Wiki Article

If You're Thinking Of Trading Online In Forex, You Should Consider The Following 10 Tips On Understanding The Market And A Strategy.

Forex trading can be challenging However, with the right knowledge about markets and strategic approach, you can manage risks and increase your chances of success. Here are the top 10 important points to take into consideration when trading Forex online: 1.

Understanding Economic Indicators

In Forex, economic indicators (such as the growth rate of GDP and employment reports) are crucial as they reveal the health of an economy. For example, strong employment data from the U.S. typically strengthens the USD. Keep up-to-date on the schedule of economic happenings.

2. The focus is on risk management

Develop a risk management strategy starting from the beginning. Establish take-profit and stop-loss limits to safeguard your investment and avoid excessive losses. Many experienced traders advise taking a risk of only a small portion of your account (e.g. 1-2 percent) on a single trade.

3. Utilize Leverage With Care

Leverage can increase the amount of losses and gains therefore, use it with care. It's recommended to start with a lower leverage until you are aware of how leverage impacts your position. Over-leveraging leads to major losses.

4. Create an Investment Plan

A solid trading strategy can help you keep your focus. Define trading goals including entry and exit points, and your risk tolerance. Create your strategies depending on whether you plan to utilize fundamental or technical analysis.

5. Learn the basics of technical analysis

Analysis of the technical aspects is essential to Forex trading. Familiarize you with trendlines, support and levels, moving averages, and candlestick patterns. These tools aid in identifying potential trading opportunities, and also manage the entry or exit point efficiently.

6. Stay informed on Global News

Trade agreements, political events central bank policies and natural catastrophes can profoundly affect the currency markets. A central bank's surprise cut in interest rates can make its currency weaker. Be aware of the latest the latest news around the world will allow you anticipate any changes on the market.

7. The Correct Currency Pairs

For those who are new to the world, certain currencies like EUR/USD GBP/USD USD/JPY are better due to their greater liquidity and stability. While exotic pairs can offer some high returns, they are also more unstable and risky. Understanding each currency pair's characteristics can help you choose the one that is suitable for your style of trading.

8. Practice on a Demo Account First

Use a Demo Account to test strategies and to become acquainted with trading platforms before diving into live trading. This allows you to increase your confidence, practice your strategy and make mistakes without risk.

9. Check Interest Rates and Central Bank Policies

Central banks play a significant part in the valuation of currencies through interest rates and monetary policy. A high interest rate can draw foreign investment, and also increase the strength of the currency. Lower rates could reduce its strength. Tracking decisions by the Federal Reserve, European Central Bank, or other central banks can give you valuable insight into currency trends.

10. Keep an Journal of Your Trades

A detailed trading log can improve discipline and help to highlight your strength and weaknesses. Document every trade's entry and departure points, the reasons for the trade, and the outcome. Analyzing this record periodically can reveal patterns in your trading and aid in adjusting your strategy over time.

Forex trading requires a thorough market knowledge, strategic planing and a disciplined approach to implementation. Be aware and take control of your risks. Change strategies to market conditions as they alter. View the top rated https://th.roboforex.com/ for blog recommendations including top forex trading apps, app forex trading, fx trading forex, best forex brokers, forex trading platform, fbs broker review, fx forex trading, best forex trading broker, best currency trading platform, forex market online and more.

The Top 10 Things To Take Into Consideration When Trading Online For Forex: Technical And Fundamental Analysis

Fundamental and technical analysis play a crucial function both in Forex trading. They will help you make more informed choices. Here are 10 strategies for using technical and fundamental analyses in trading online Forex trading.

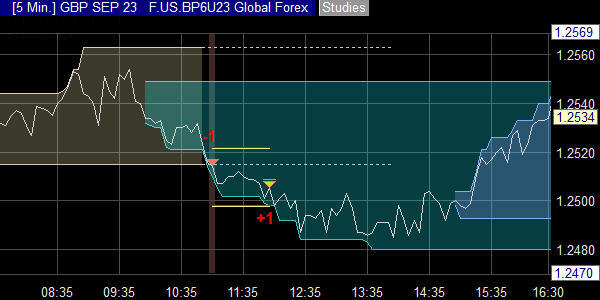

1. Identify the Key Support and Resistant Levels

Support and resistance levels are levels at which currency pairs tend to pause or reverse. These levels act like psychological obstacles. They are therefore important to plan out entries and outs. It is crucial to identify these zones in order to know the areas where the market could turn or break out.

2. Use multiple timeframes to gain an overall view

Analyzing charts in different timeframes (e.g. daily, four hours or even a single hour) can give insight into trends and the overall picture. The higher timeframes reveal the overall trend, while lower timeframes show specific entry points and timings.

3. Master Key Indicators

Moving Averages, Relative Strength Index (RSI), Moving Average Convergence Divergence Divergence(MACD) are all essential indicators when it comes to Forex trading. You can improve your analysis by understanding the way each indicator works and then combining them.

4. Candlestick patterns: Pay close attention

Candlestick patterns such as dojis, hammers, or patterns of engulfings can indicate possible reversals. Familiarize yourself with these patterns to recognize possible price action changes. Combining candlestick analysis with other tools, such as support/resistance can enhance your trading timing.

5. Analyze trends for directional indications

Utilize trendlines and moving averages to determine uptrends, downtrends or markets that are swaying. Forex traders tend to adhere to the trend since it gives more consistent results. Trading against the trend is not advised unless you are extremely experienced.

Fundamental Analysis Tips

6. Know the Central Bank policies and interest Rates

Central banks, such as the Federal Reserve or the European Central Bank manage interest rates which have an impact directly on the value of currency. Higher interest rates can increase the value of currencies, while low rates can make them weaker. Keep track of central bank announcements as they often trigger significant market moves.

7. Pay attention to economic indicators and reports.

Important economic indicators like unemployment, GDP, inflation, or consumer confidence can offer important insights into the health of an economy country and affect the value of currency. Keep up to date with the most recent economic news and assess how they impact the currency pairs you have.

8. Examine Geopolitical Events and News

The market for currency can be affected by political events, such as elections, negotiations or conflicts. Stay informed about global events especially those that affect the major economies like China, the U.S. and China. Prepare to alter your plan if abrupt geopolitical changes occur.

Combining Technical and Fundamental Analysis

9. Aligning technical signals with fundamental Events

Combining the technical analysis with fundamental analysis will improve your decision-making. When a technical analysis displays an uptrend when paired with an optimistic economic forecast it can provide more of a positive signal to buy. Combining the two approaches can reduce the uncertainty and increasing your chances of getting it right.

10. Utilize risk events to trade Opportunities

Events that have a high impact, like Federal Reserve meetings or non-farm payroll (NFP) announcements, cause the risk of volatility, and often result in rapid price movements. A lot of traders stay away from these unpredictable events because they're difficult to forecast. If you've had a good experience and you're in a position to utilize the technical analysis associated with these events to gain from price movements. Be cautious, make sure you set strict stop loss orders and prepare to adjust quickly.

In Forex trading, the combination of technical and fundamental analysis provides a comprehensive understanding of market movements. When they master this method, traders can navigate more effectively in the market for currency, make more informed decisions and enhance their performance. Check out the top https://th.roboforex.com/partner-program/ for site examples including united states forex brokers, best forex trading platform, forexcom, currency trading demo account, forex brokers list, best currency trading platform, fx trade, best currency trading platform, forexcom, recommended brokers forex and more.

Top 10 Trading Platform And Technology Tips For Those Who Are Considering Forex Trading Online

1. Forex trading is a nitty-gritty business. Understanding the technology and deciding on the most suitable trading platform is crucial. Here are our top 10 tips for using the latest technology and trading platforms to enhance your experience.

Choose a platform with a user-friendly interface

Opt for an intuitive platform that is easy to navigate. You should be able to use charts, monitor trades, and even place orders. Popular platforms like MetaTrader 4, MetaTrader 5, and TradingView offer user-friendly interfaces.

2. You will require a high-speed internet connection.

Forex trading requires reliable and speedy internet access. Instabil or slow connectivity could cause the loss of opportunities, slippage and a delay in order execution. Think about upgrading your internet or using the Virtual Private Server for a more stable connections.

3. Test Order Execution Rate

Speed of execution for orders is crucial especially when you are day trading or scalping. Platforms with quick execution times can reduce slippage, allowing you to enter and exit trades exactly at the rate you want. Try out the platform with the demo account prior to investing in a live account.

4. Explore Charting and Analysis Tools

A robust platform should offer advanced charting options including indicators, as well as tools for analysis of technical data. Platforms that offer customizable charts, a wide range of indicators, as well as detailed technical analysis are the top. This will allow you to make more informed decisions about trading.

5. Look for mobile trading features

Mobile trading applications offer a variety of options in monitoring and managing trades while on the go. Make sure the app on your mobile has all the necessary features, including charting, trades and account monitoring.

6. Automated Trading Options

A lot of traders employ automated trading or algorithmic strategies to increase efficiency and reduce manual work. If you're looking to automatize your trading, choose an online trading platform that is compatible with EAs (expert advisors) or bots. MT4/MT5 is compatible with a variety of automated trading software.

7. Verify Security Features

Security is a must when it comes to online trading. Choose a platform that has encryption protocols (copyright), two-factor verification (copyright) as well as additional security features to guard your personal information and funds. Be cautious of platforms that do not have robust security features as they may expose you cyber threats.

8. Also, you can check out the latest news and real-time data.

Live price feeds as well as economic news alerts are essential for timely trading decisions. A good platform will provide the most current and accurate market information and integrate news feeds from trusted sources. This allows you to keep up-to-date with developments that could affect your trading.

9. Make sure that the product is compatible with your style of trading

Different platforms suit different trading styles. Platforms that offer one-click trades and quick execution are good for those who scalp. Platforms that provide comprehensive charting tools and analysis are ideal for swing trading. Make sure the platform you select matches your trading style.

10. Test Service and Support Reliability for Customer Support and Platform

A reliable customer service is vital, especially when you're facing difficulties with your platform or require technical assistance. Examine the team's responsiveness and knowledge by reaching out for help. Also, look over the reliability of the platform and uptime. In the event of frequent crashes or downtime, it can have a negative effect on the performance of your trading.

By choosing a trading platform which aligns with your requirements and understanding the technical aspects of it you can enhance the efficiency of trading. This will enable you to better control market movements. You should consider the safety and usability aspects, as well as the tools that you require to suit your style of trading. Have a look at the recommended https://th.roboforex.com/about/activity/awards/ for site recommendations including best forex trading app, united states forex brokers, good forex trading platforms, app forex trading, broker cfd, good forex trading platforms, united states forex brokers, app forex trading, best forex trading app, currency trading platforms and more.